Capital expenditures, including those for computers, office equipment and machinery can be a critical component to ensuring your shop's efficiency and its growth. The end of the year is the perfect time to weigh the pros and cons of investing in new equipment, and assess your business needs, goals and resources. Note that to be eligible for a 2025 Section 179 deduction, the eligible equipment must be purchased and put into service by midnight 12/31/2025. It is not enough to simply buy the equipment!

Specifically, for machine shops, investing in new machinery offers a range of benefits including:

- Increased efficiency & productivity: investing in machinery that can complete a task faster, reduce manual or repetitive tasks, or achieve a more quality finish that can eliminate or reduce post-production tasks can generate increased efficiencies that translate to higher productivity rates and increased cost savings.

- Improved safety: new machinery generally offers increased safety features. Older equipment, regardless of how well it is maintained, can present safety risks as the machinery's mechanisms experience wear and tear and depreciate over time.

- Increased capabilities & competitiveness: new machinery can increase your capacity and allow you to take on more jobs or perform production runs in less time.

- Increased autonomy & ownership: purchasing machinery vs. leasing it allows you to make modifications to machinery when necessary, without being at the mercy of a leasing company. Additionally, purchasing your machinery allows you to take full advantage of tax incentives. While applicable for leased machines as well, Section 179 of the IRS Tax Code (see below), allows you to deduct the full purchase price from your gross income, for up to a $2,500,000 deduction.

TAX BENEFITS OF PURCHASING MACHINERY:

How To Take Advantage Of Section 179 Tax Incentives

Section 179 of the IRS tax code allows businesses to deduct the full purchase price of qualifying equipment (purchased or financed) during the tax year – meaning that if you buy a piece of qualifying equipment like a machine, you can deduct the full purchase price from your gross income.

In years past, when your business made capital expenditures, it typically wrote them off a little at a time, through depreciation. For example, if your company spent $20,000 on a machine, it likely wrote off $4,000 a year for five years. Section 179, however, allows your business to write off the entire purchase price of the qualifying equipment for the current tax year. Taking advantage of Section 179 can allow you to purchase needed equipment right now, instead of waiting.

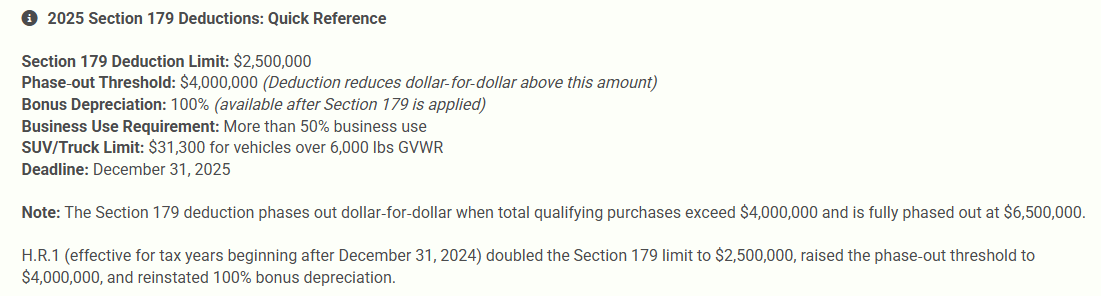

THE SPECIFICS OF the SECTION 179 deduction:

What Does Section 179 Mean For My Business?

Sole Proprietorships, Partnerships or S-Corporations:

- Section 179 Deduction: Companies may deduct the amount spent on purchasing new or used equipment from their taxable income. The annual deduction limit is $2,500,000 for companies that purchase or lease up to $4,000,000 of equipment.

- Bonus Depreciation: After the Section 179 deduction limit has been reached, companies can utilize Bonus Depreciation, immediately deducting 60% of the cost of new or used equipment the year it is placed into service, through 2025.

C-Corporations:

Section 179 Deduction: This works mostly the same as above, allowing C-Corporations to deduct the amount spent on purchasing new or used equipment from their taxable income. The recent law changes increased annual deduction limit to $2,500,000 for companies that purchase or lease up to $4,000,000 worth of equipment each year.

Section 179 Deduction: This works mostly the same as above, allowing C-Corporations to deduct the amount spent on purchasing new or used equipment from their taxable income. The recent law changes increased annual deduction limit to $2,500,000 for companies that purchase or lease up to $4,000,000 worth of equipment each year. - Bonus Depreciation: This incentive allows your business to immediately deduct 60% of the cost of eligible equipment the year it is placed into service. This is applicable for new and used equipment purchases.

NOTE: The IRS restricts what can be expensed with a Section 179 deduction, as well as the maximum amount of the deductions made. CONSULT YOUR ACCOUNTANT OR TAX PROFESSIONAL if you are considering taking a Section 179 deduction. For a detailed listing of current section 179 details, see the section 179 website.

NEED MACHINERY SELECTION ASSISTANCE?

Talk To Our Machinery Experts!

As you consider purchasing new machinery, you can request assistance from our machinery experts and technical support team, who can review your machinery needs and recommend the right solution for your shop. Plus, we can assist you in selecting tooling packages that heighten your machinery's performance and take your productivity and efficiency further.